Disclaimer

NK Asphalt is not a registered investment, legal, or tax advisor. Advice expressed in this article was researched and is intended as a generic guide only. Although best efforts are made to ensure all information is accurate, we recommend seeking advice from a registered accountant or tax advisor about the tax implications before committing to a project.

When budgeting for asphalt driveway or car park costs, it’s important to consider the potential tax deductions available. Based on the intended use, you may be able to claim asphalt repairs or resurfacing on your tax return.

In this article, we explore whether your asphalt project is applicable for a tax deduction and share some examples that may resonate with you.

Is your asphalt driveway cost included?

The cost of an asphalt driveway may be tax deductible depending on its function within a residential or commercial property. If you’re planning a new asphalt project solely for personal use, unfortunately you won’t be able to claim any of the asphalt driveway cost.

The Australian Taxation Office (ATO) only considers a tax return on acquisitions that provide a benefit to income producing activities. This includes commercial properties, residential rentals, and income producing home businesses, which we look at next.

Residential property inclusions

Residential properties can only claim on an asphalt driveway cost if there is sufficient evidence that it was used regularly for income producing activities. Say you reside on a large semi-rural property and operate a business from the rear of the property, any asphalt driveway costs exclusively used for business operations are tax deductible – similarly to a commercial property.

In the same way, if you need to replace an asphalt driveway because it’s in disrepair, you can claim for ‘repairs and maintenance’. However, full replacement may only be depreciated over a longer term.

If the asphalt driveway is utilised at any time for personal use, the tax deductions will be reduced. For example, if you provide a hair cutting service from your house and you need a new asphalt driveway to operate efficiently, this would only be partially deductible. Since the new driveway will be used personally too, you’re required to apportion the asphalt driveway cost into private use and work use.

There are other tax implications for residential properties used for work, including the need to pay Capital Gains Tax. If you’re unsure about the tax legislations for an asphalt driveway cost, make sure to consult an accountant.

Residential rental properties

If you own a residential rental property, you may be eligible to claim an asphalt driveway cost in your tax return.

In most cases, a new asphalt driveway is simply replacing a damaged driveway. In this case, tax deductions will be determined by whether the damage was sustained as a result of renting the property out or not. If damage was caused by the tenant/s, the new asphalt surface maybe classified as a ‘repair’.

If the asphalt driveway cost provides a completely new aspect to the property and makes the property more valuable, it would be considered an ‘improvement’ come tax time. Improvements are either Capital Works or Capital Allowances. An example of an asphalt improvement would be a long semi-rural driveway replacing a dirt track to be claimed over a longer period.

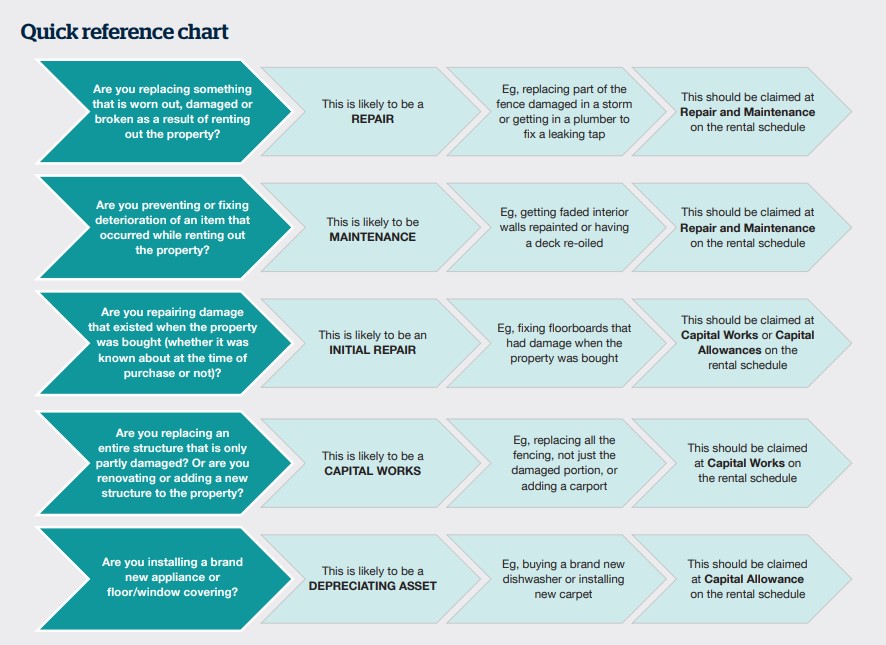

For a general overview of tax returns on rental properties, see the chart below:

Source: ATO

Commercial asphalt driveway cost

Much like rental properties, an asphalt driveway cost needs to be classified as a repair, maintenance, or improvement. This applies to any project including a new asphalt hardstand or car park surfacing.

If you purchased a commercial property with a damaged asphalt surface and are looking to replace it, you may not be able to make a claim on the project. Since the price you paid for the property reflected the condition of the property, any asphalt driveway cost is likely to be considered an improvement, rather than a repair.

Again, it’s always best to consult an accountant regarding tax legislation for a new commercial asphalt driveway cost.

Tax deduction for depreciating assets

If you can justify the cost of an asphalt driveway as being beneficial for income producing activities, you may be eligible for a depreciation deduction. An asphalt driveway will decline in value over the years, making it a depreciating asset. Owners of income-producing properties can claim under two categories: Capital Works or Division 43 and Plant and Equipment or Division 40.

A commercial car park in dire need of resurfacing may be eligible to claim come tax time.

The bottom line

When considering if a new asphalt driveway cost is tax deductible, always seek the help of an accountant beforehand. If they determine you’re eligible for some deductions, it’s important to have the evidence to back it up. Some of the necessary factors required by the ATO are:

- The details of the asphalt driveway construction.

- The date that construction commenced on your property.

- The date that construction was finished.

- The asphalt driveway cost to construct (not the valuation).

- Details of the asphalt contractor, so NK Asphalt.

- Details concerning the times during the year that the property was used to produce income.

If you’ve previously had an asphalt project completed by us and have misplaced invoices including these details, feel free to contact the friendly team at NK Asphalt.

Want to know what an asphalt driveway costs?

Despite not being tax experts, we sure know a lot about asphalt driveways, car parks and hardstands! Established in 1989, with over 30 years of industry experience, NK Asphalt delivers the very best asphalt services to Perth and the surrounding areas.

Let us help you plan your budget with an accurate asphalt driveway cost below.

Get an asphalt driveway quote

If your job is 150m2 or more and in the Perth or surrounding areas.

share